Create Additional Pay eDoc

Update coming soon.

The Create Additional Pay eDoc is used to process additional pay for an active employee. Examples include, academic overloads, temporary pay, reward and recognition payments, supplemental pay, academic administrative supplements, and allowances.

Additional Pay is pay outside of the regular wages or base salary pay for an employee. Bi-weekly paid employees performing services for another department should be processed as an hourly HIRE with a bona-fide hourly rate of pay based upon the services provided.

Create Additional Pay eDoc Process

- In One.IU navigate to the eDocs page in the HRMS Portal, click on Create Additional Pay.

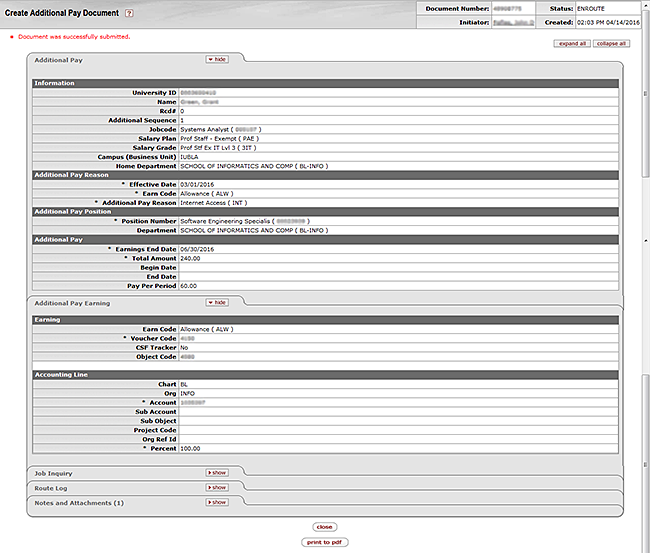

- The Create Additional Pay eDoc is made up of two major sections: Additional Pay and Additional Pay Earning.

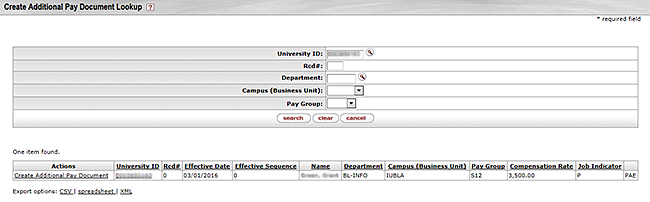

Create Additional Pay Document Lookup:

Look up the employee for whom you want to create an Additional Pay, by entering available information that you have into the appropriate areas and clicking on ![]() .

.

NOTE: It’s best to try to obtain the University ID, but if you don’t have it, you may utilize the other available search options below.

Choose Create Additional Pay Document in the Actions column. If the search returns multiple job records, select the job record with the most recent effective date.

Enter information in the required fields (noted by any asterisks) as follows:

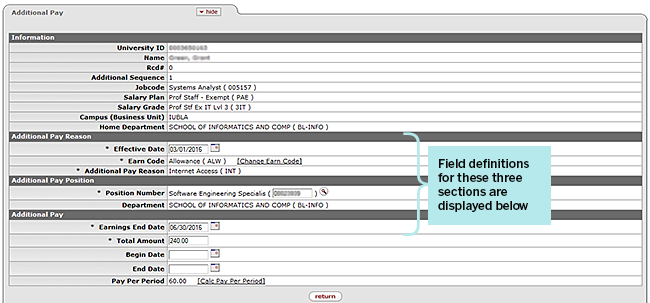

Additional Pay Reason

- Effective Date: The Additional Pay Effective Date should be in most cases, the first day of the pay period in which the additional pay is to take effect. For staff monthly employees, the additional pay should begin on the first of the month. For bi-weekly paid employees the additional pay should begin on the first day of the bi-weekly pay period in which the additional pay is to take effect.

Additional Pay effective dates are restricted by Job Data effective-dated boundaries, so you may not always be able to follow the above guidelines. Always try to set the effective date as early in the pay period as possible. When processing an Additional Pay for Temporary Pay, the Effective Date and Earnings End Date should reflect the true dates of the period for which the additional duties are being performed. An adjustment voucher may be processed for over payments.

Payroll calendars can be found at: fms.iu.edu/payroll/payroll-calendars/

- Earn Code and Additonal Pay Reason: The type of Additional Pay being paid to the employee is defined by Earn Code. eDoc logic evaluates the position type of the employee being paid the Additional Pay and presents only the valid Earn Code options displayed in the dropdown box. In our example, we have chosen Allowance. Once the Earn Code has been chosen, eDoc logic will then pull forward the Additional Pay Reason field and will present the Additional Pay Reason options for that Earn Code.

Additional Pay Position: eDoc logic defaults the position of the employee being paid the Additional Pay and displays the department of that position. If the Additional Pay is being paid to the employee for work performed in a different department, you may use the position number lookup to choose a generic Additional Pay position, as follows:

- Additional Pay: Acad Services (Salary Plan AP)

- Additional Pay: Staff Services (Salary Plan APS)

Select the appropriate position from the two above based on the work to be performed.

Additional Pay: To complete the Additional Pay section of the eDoc, enter to following information:

- Earnings End Date – This is the effective date that the Additional pay will end.

- Total Amount – This is the total amount of the Additional Pay.

- Pay Per Period - This is the total amount of the Additional Pay divided by the number of Pay Periods that are included between the Effective Date and the Earnings End Date.

- Begin Date and End Date – these fields are not required and are merely available for eDoc initiators use as additional information. Example – Use the date fields, to denote the date range of a project performed by an employee on an Additional Pay type of Bonus, where the bonus was approved many months after the project was completed. Then additional information regarding these dates can be added in the Notes and Attachment section of the eDoc.

Note - Additional Pay for Temporary Pay: Temporary Pay is based on a percentage of the employee’s salary, so the Total Amount and Pay Per Period fields are not needed for this calculation. Therefore, they do not appear on the eDoc.

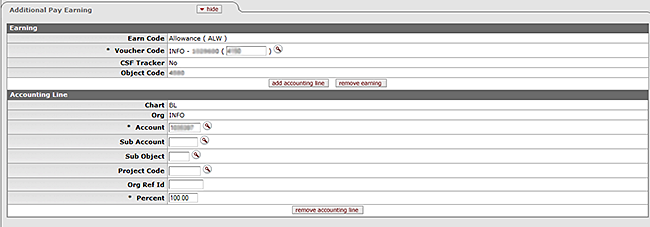

Additional Pay Earning

- Earning: The Earn Code displayed reflects the Additional Pay that was selected above. A Voucher code is chosen from the department’s available codes. The code selected is the code from which the Additional Pay is paid.

- Accounting Line(s): Enter the appropriate accounting information; note the account number is required, but you may also choose to complete some of the other fields to account for the Additional Pay cost (Sub Account e.g.). Finally, enter the appropriate percentage for this account. Percent is required and if multiple accounting lines are used for the funding, they must equal 100%.

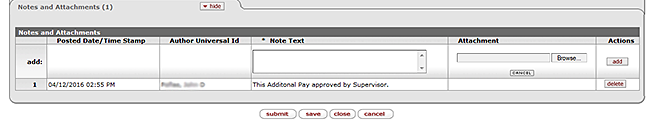

Notes and Attachments

Below is a typical note you might add. You may also add an attachment such as a spreadsheet, PDF file or a Word document.

Once you’ve reviewed your eDoc one final time, ![]() select to route the eDoc for approval. The eDoc should say, “Document was successfully submitted.”. Now select

select to route the eDoc for approval. The eDoc should say, “Document was successfully submitted.”. Now select ![]() at the bottom of the document. Note that the status has changed to “ENROUTE”.

at the bottom of the document. Note that the status has changed to “ENROUTE”.

Take Action

During document preparation you may want to save or close the eDoc to finish it later or for whatever reason you may have a need to cancel it. Otherwise, once you have reviewed your document and

| Take this action when you’ve completed and reviewed your eDoc and are ready to submit for routing. | |

| This action saves the eDoc back to your Action List if you need to complete and route it at a later time. | |

| This action closes the eDoc for you once you save, cancel or submit it for routing. | |

| This action cancels the eDoc for you. Please use the cancel button rather than the “X” in the upper right corner of your browser screen. Closing an eDoc using the “X” in your browser, may cause any further actions on the employee’s record to be blocked without technical assistance. |

The full screen will appear as below:

EARN CODE - REASON DESCRIPTIONS

Note: The earn code-reason choices listed below are a representative sample of earn code options. When you initiate the eDoc, the available options will appear on the drop down. Options will vary based on the Paygroup of the employee you choose. See descriptions below.

Academic Administrative Supplemental Pay (AAD) - object code 2200

Pay for additional administrative duties performed by an academic employee.

Rules - Limited to academic employees.

Academic Overload (AOV) - object code 2170

An academic overload is additional earnings for an assignment that is academic in nature but is not part of the employee’s regular role. Academic overloads primarily result when academic or PAE employees teach extra courses if another qualified instructor cannot be found or due to other extenuating circumstances.

Rules - Limited to full-time academic and exempt staff employees. Requests for overloads are documented by providing a written explanation detailing the type of services being provided and the time period involved. Depending on the campus, documentation may be required for all academic overloads. The written justification explaining the basis for the overload should be incorporated into the Notes section.

Agreement (SET) - object code 4580

Payment associated with a legal agreement. Reasons for agreements include grievance, injury and severance. The use of this Earn Code is restricted, contact campus HR office with questions.

Allowance (ALW) - object code 4580

Payments associated with car, housing, digital communications, internet, moving or tool allowances.

Rules - Limited to academic and staff employees.

Bonus – Discretionary (BON) – object code 4580

After-the-fact discretionary lump sum payment provided to reward exemplary performance and achievement of quantifiable results beyond the normal expectations for a position.

Please refer to the Reward Plans and Recognition Plans policy for specific guidelines.

Rules - Limited to staff and hourly employees.

Displacement Allowance (DSA) - object code 4580

A displacement allowance is given to help provide a cost of living adjustment for working outside Bloomington or to defray the costs of maintaining an additional place of residence.

Rules - Limited to academic and exempt staff employees.

Faculty Fellowships (FCF) - object code 4580

Description - Academic fellowships awarded primarily during summer months.

Rules - Limited to academic employees, payment is made as specified.

Incentive or Commission Pay (INP) - object code 4588

Incentive or Commission payment(s) are documented, defined bonus plans designed to reward achievement of specific, measurable results that are defined at the beginning of the performance period. This may be a lump sum for exempt staff or payments for prior pay periods for exempt and non-exempt employees.

Please refer to the Reward Plans and Recognition Plans policy for specific guidelines.

Rules - Limited to staff and hourly employees.

Overseas Allowance (OSA) - object code 4580

An allowance given to compensate for being overseas.

Rules - Limited to academic employees.

Recognition Award (AWD) - object code 4580

Pay associated with an established award such as staff merit awards, outstanding teaching awards and other nominated awards.

Note that FYI routing includes department and organization in cases where the award is made at the campus level.

Please refer to the Reward Plans and Recognition Plans policy for specific guidelines.

Rules - Limited to staff and hourly employees.

Research Leave (RLS) - object code 4580

A supplement given to academic employee on leave from regular duties to perform research. Typically, the employee is on a prestigious leave.

Rules - Limited to academic employees.

Retention Incentive Pay (RET) - object code 4580

Payment to productive academic employees who would otherwise terminate and begin receiving 18/20 Plan benefits. The use of this Earn Code is restricted, contact campus HR office with questions.

Supplemental Pay (SPS, SPT, and SUP) - object code 4580

Payments to provide compensation for occasional services provided to the university by an employee outside of the normal work effort of his/her position. Reasons for a supplemental include: (1) teaching intermittent, short-term courses, (2) giving a lecture or limited number of lectures and (3) one time services typically performed for another department outside the normal work effort.

Please refer to the Supplemental Pay Policy

Rules - Payment is made upon completion of service. Limited to academic and exempt staff employees.

Temporary Adjustment (TP0, TP3, TP4, TP5, TP6, TP7, TP8, TP9, TP10, TP15 and others). Regular pay object codes are used.

When an employee is temporarily assigned more complex higher level responsibilities management may request a temporary pay adjustment expressed in a percentage increase from 3% to 25% of regular compensation rate.

Please refer to the Temporary Pay Policy for the relevant employee group for specific guidelines and approval processes.